This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Diploma in Certified Financial Management

Learn from

India's Top Ranked

Institute

Ranked 12 in MHRD-NIRF*

*National Institutional Ranking Framework

Accredited with the highest NAAC* ‘A++’ grade*

*National Assessment and Accreditation Council

Globally ranked 4-Star university with a ‘Diamond’ rating by QS-IGAUGE India

*QS World University Rankings

Why Choose this Program?

Comprehensive

Curriculum

Curriculum designed by leading academicians and industry experts

Immersive Online

Learning Experience

LIVE Online Learning designed for Working Professionals

Taught by India’s top management faculty

Student Support

Services

AI Based Students Support, 24*5 Chat Support, Comprehensive Helpdesk Support

Diploma from SRM

Programme Fee

Domestic Structure

Online Learning

16,000* / Semester

*Exclusive of Examination fee

International Structure

Online Learning

$ 640* / Year

*Exclusive of Examination fee

Note: In addition to the tuition fees, the Exam fees for the semester and fees for certificates will be charged separately

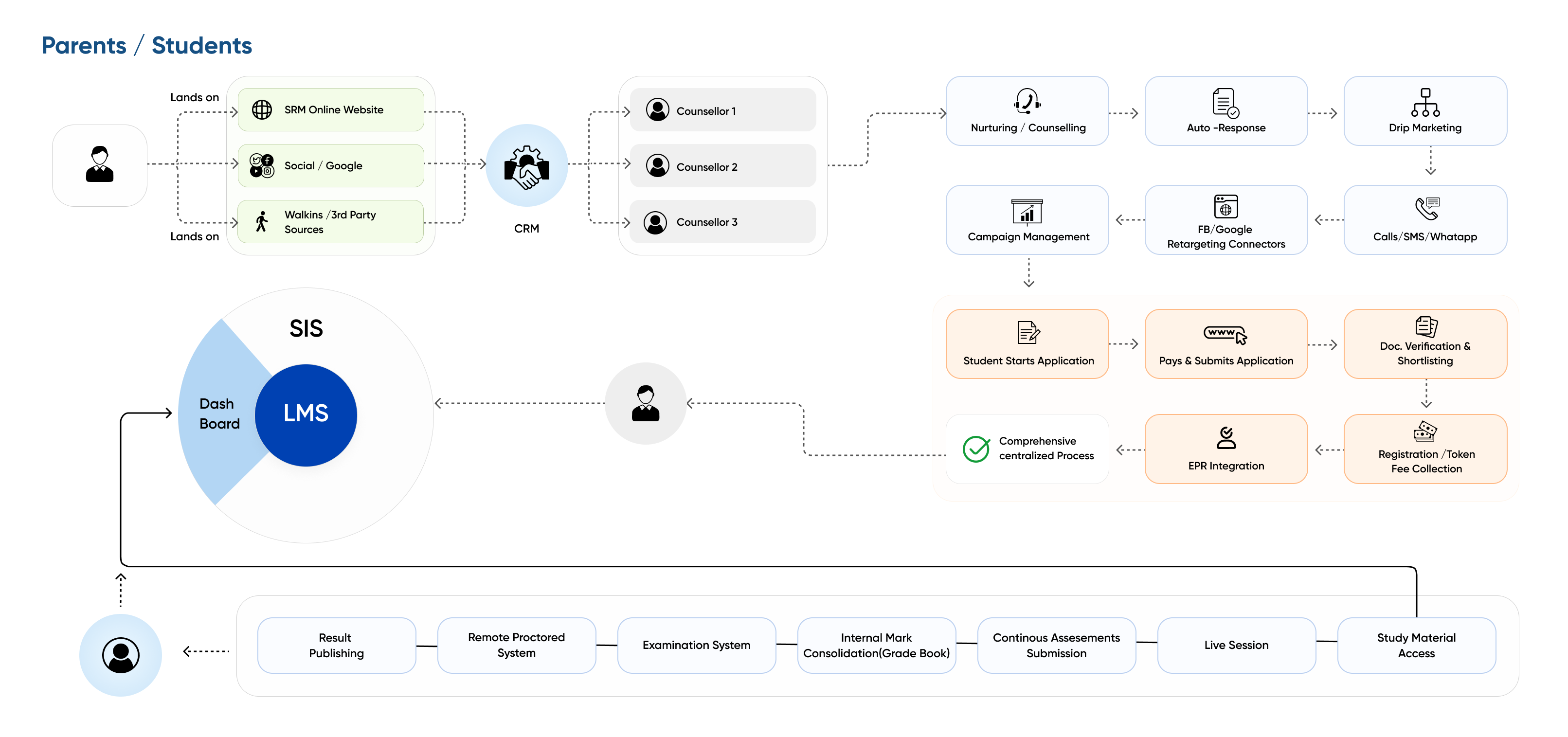

Students Gateway

Learn from one of the best management schools in India

Live Online Learning | UGC Entitled | AICTE Recognized | Category One University

This course is designed to enhance the capabilities of finance professionals and also serves as a first step in the Finance Management profession. For managers in today's business world, it's essential to have a working knowledge of finance.

The Scope of this financial management courses mainly involves in understanding the business requirements, making plan, and manage all corporate transactions and managing the company assets such cash, machinery, land, tracking associated costs, and ensuring the profit for the business. As a Finance manager, they are responsible for the financial health of an organization. They create financial reports, direct investment activities and develop plans for the long-term financial goals of their organization.

So, by understand the role and importance of a financial manager, they can identify and evaluate the alternative sources of business finance, discuss and apply working capital management techniques, understand the factors influencing cost of capital and calculating cost and also, they take decision on capital structure and evaluate the financial viability of investment.

Curriculum

Semester 1

| Subject Code | Subject Title | Credit |

|---|---|---|

| V24DCFM01T | Essentials of Financial Management | 4 |

| V24DCFM02T | Technology in Finance | 4 |

| V24DCFM03T | International Finance | 4 |

| V24DCFM04L | Internship | 8 |

| Total | 20 | |

Semester 2

| Subject Code | Subject Title | Credit |

|---|---|---|

| V24DCFM05T | Investment analysis and portfolio management | 4 |

| V24DCFM06T | Financial Markets, Institutions and Instruments | 4 |

| V24DCFM07T | Taxation | 4 |

| V24DCFM08L | Project | 10 |

| Total | 22 | |

The "Diploma in Certified Financial Management" course is typically suited for individuals who aspire to pursue a career in finance and want to gain comprehensive knowledge and skills in financial management. Here are the key groups of people who should consider attending such a course:

- Finance Professionals: Individuals already working in finance who wish to enhance their skills and credentials in financial management.

- Accountants and Auditors: Professionals looking to specialize in financial management or broaden their knowledge beyond traditional accounting.

- Business Managers and Executives: Those who need to understand financial principles to make informed business decisions and manage financial resources effectively.

- Entrepreneurs and Business Owners: Individuals starting or managing their own business who require a solid understanding of financial management practices.

- Recent Graduates: Graduates with a degree in finance or related fields seeking practical skills and certification to kick-start their careers in financial management.

- Career Changers: Individuals transitioning into finance from other fields who need foundational knowledge and certification in financial management.

- Investment Professionals: Those involved in investment analysis, portfolio management, or financial planning who want to deepen their understanding of financial management principles.

- Consultants: Professionals providing financial advisory services who need expertise in financial management to assist clients effectively.

- Government Officials: Individuals working in government finance departments or agencies who require specialized training in financial management practices.

- Anyone Interested in Finance: Individuals who have an interest in finance and want to gain practical skills and certification in financial management.

High Demand across Industries

Finance and Banking

Corporate Sector

Consulting and Advisory Services

Government and Public Sector

Healthcare

SRM Online Learning Portal: Remote Proctored Examination System (RPES) - Learner's Checklist

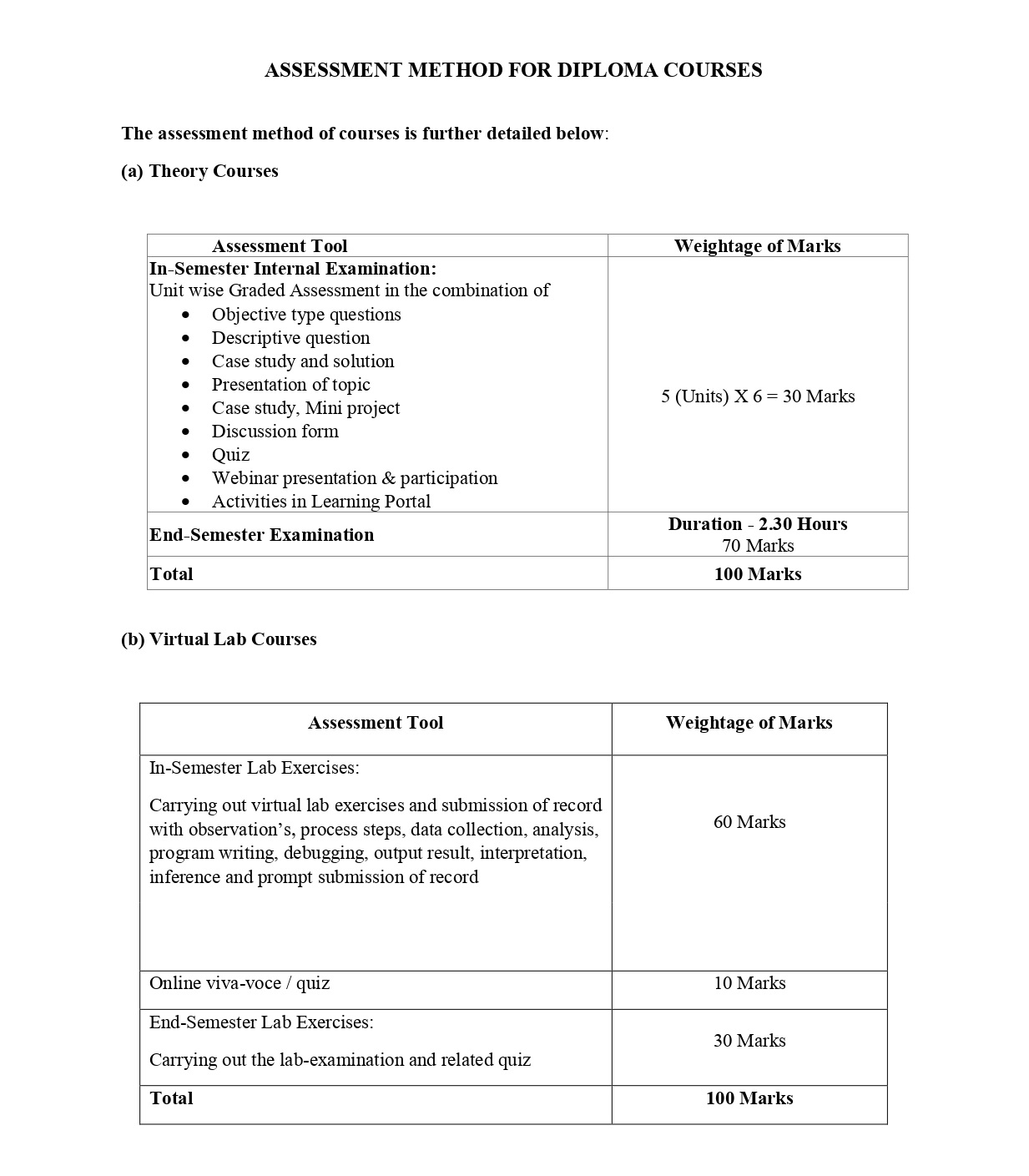

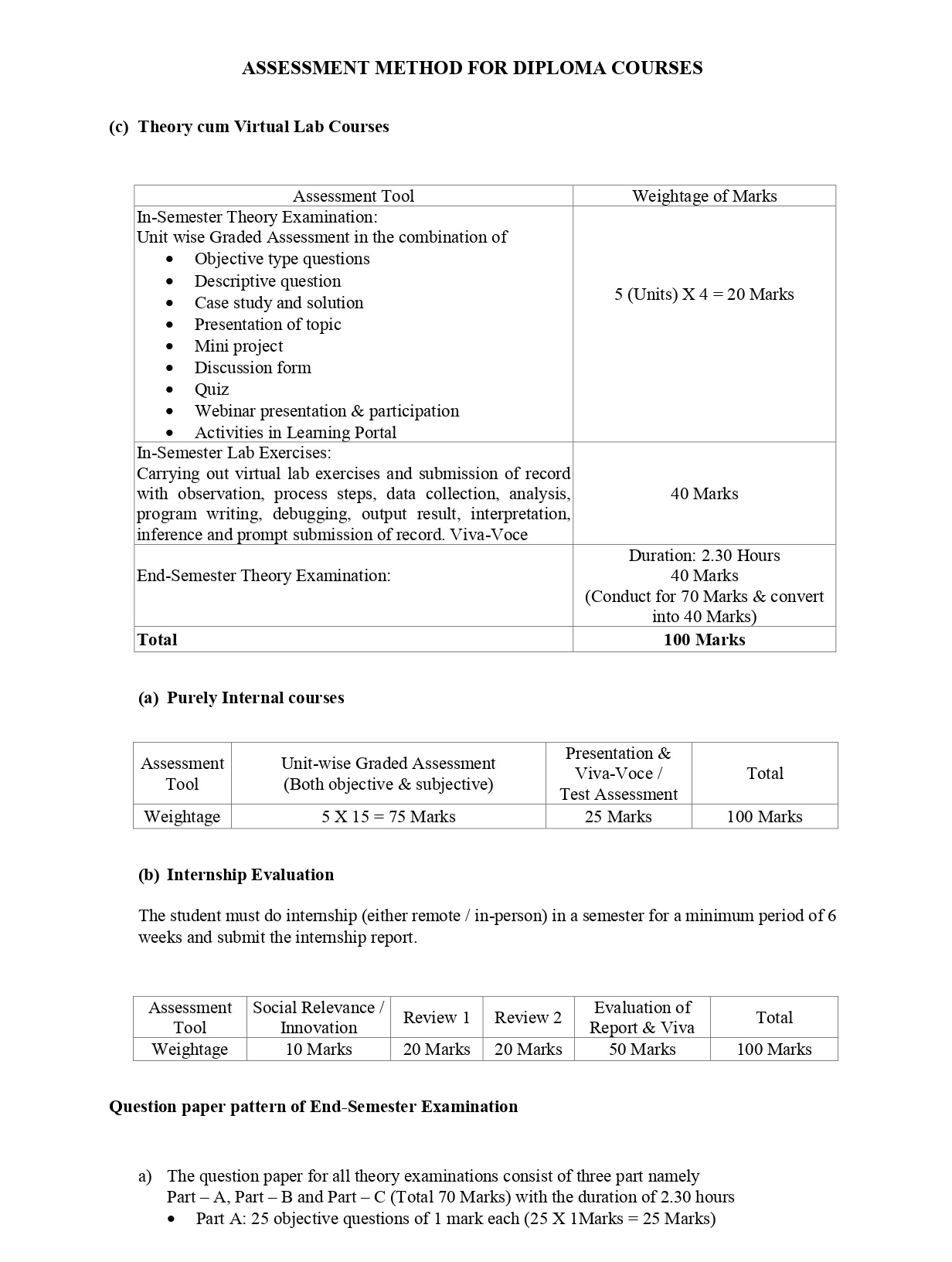

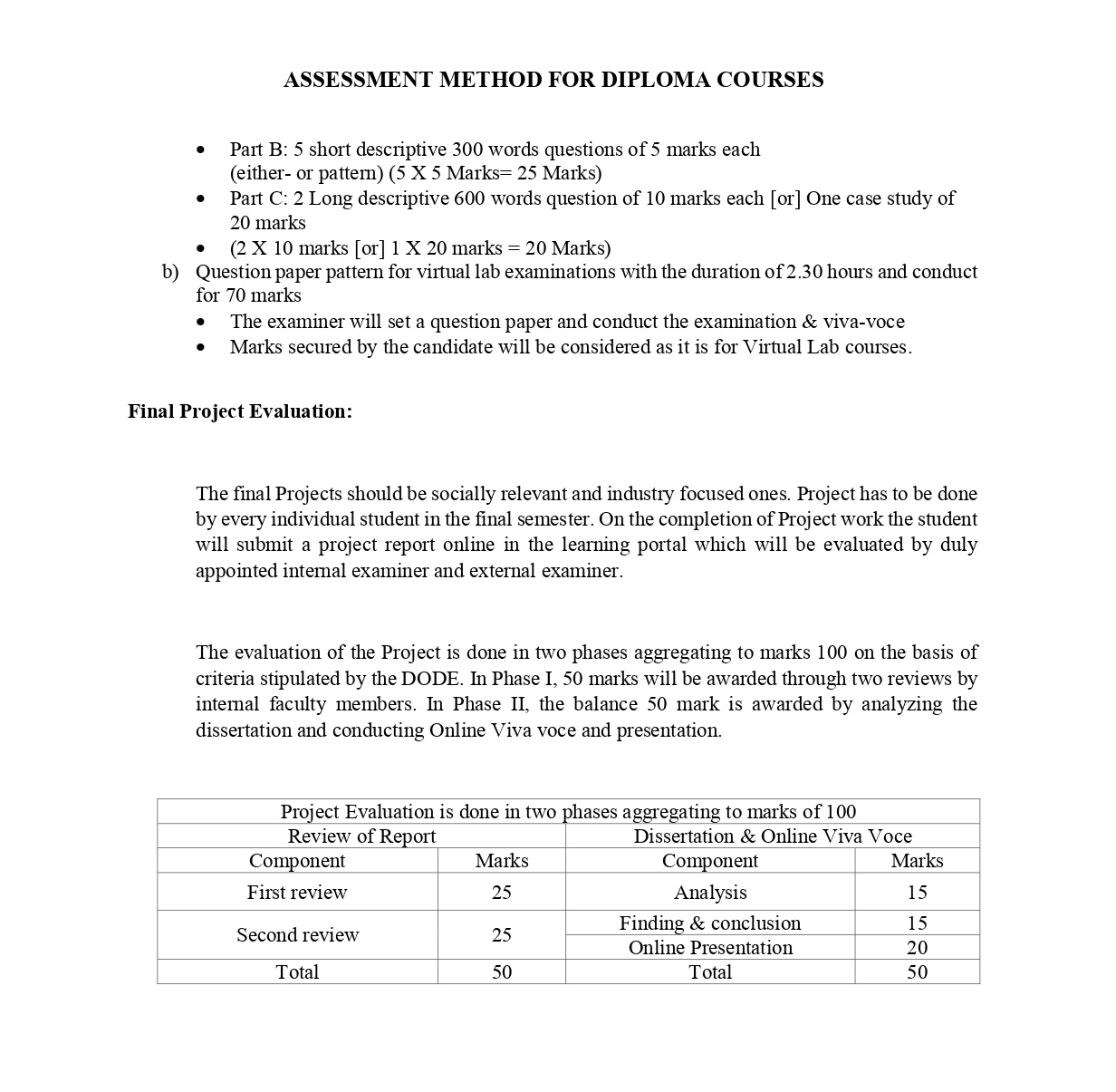

- Examination Mode: Remote Online Proctored Examination only (Theory/Practical/Project). No physical appearance is required.

- Online Examination Platform: SRM Online Remote Proctored Examination System.

- Mock test: It will be conducted before every end semester examination for software practice.

- End semester exam Pattern: Objective Type (MCQs) and Descriptive questions (Essay/Case study).

- For descriptive questions: Students need to upload the scanned answer sheet in picture format (JPG) before the exam time gets over into the RPES.

- Examination Hardware/Software Requirements: Laptop or Desktop with webcam, Windows Operating System, Good internet bandwidth, Mobile or Scanner for scanning answer sheet(s), A4 sheets as per your requirement, pen (blue or black), pencil if required.

- E-Answer sheet: Scanned answer sheet (handwritten in A4 sheets) should be uploaded before the exam time ends into the RPES.

- Authentication: SRMIST ID card and hall ticket / Admit card is mandatory to appear for the exam.

- Back Paper(s): Learners can appear for Arrears / Back papers along with every next semester till the time of maximum number of attempts permitted as per regulation.

10+ 2 years (Any group) from any recognized board including NIOS, a pass with 50% in the qualifying exams.

OR

A pass (10+3, 10+2+3, 10+3+3 pattern) with a minimum aggregate of 50%.

OR

Any Degree with a minimum aggregate of 50%

Our Program Advantage

Learn from a comprehensive curriculum taught by world-class faculty. Get guidance on your learning journey, and access career services.

CONVENIENT LEARNING FORMATS

Live Online Learning

PROGRAMME BENEFITS

Real-World Class Students

MAXIMUM FLEXIBILITY

Week – End Live Interactive Session

Admission Process

Step - 1

Application submission + Upload of

Step - 2

Selection Process

Step - 3

Selection intimation and fee payment

Step - 4

Formal enrolment of the program